At Rave Financial, protecting our members from fraud is our top priority. Below you will find tips, tricks, tools, articles, and other resources to help you stay informed, aware, and protected from fraud attempts. Be sure to check back often as this page will regularly be updated with any new trends we see.

Rave Financial will never text or call and ask for your online banking account information. Never provide your online banking account information over the phone.

Text Scams

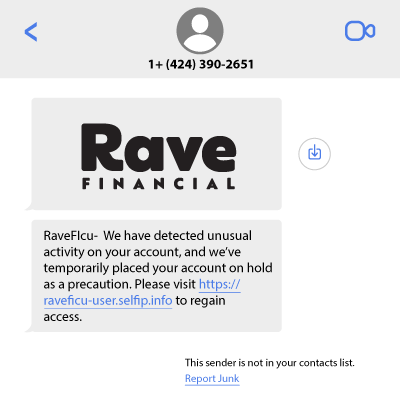

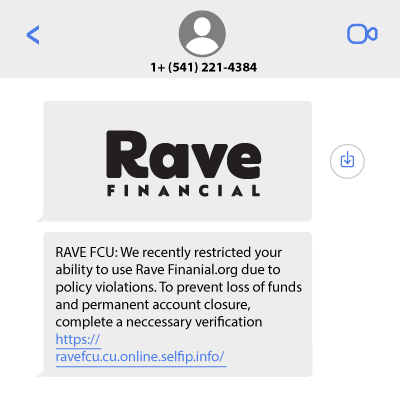

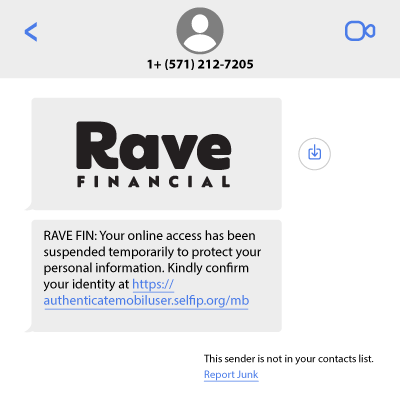

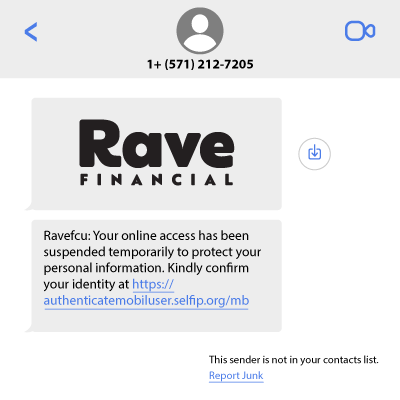

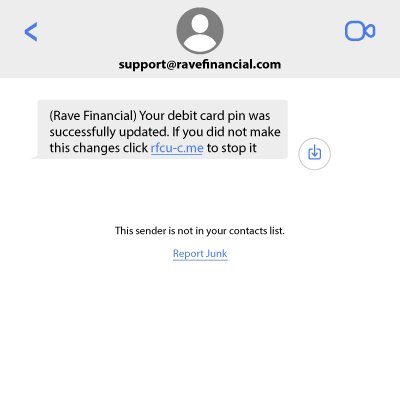

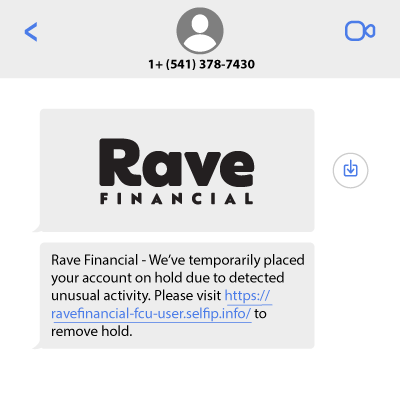

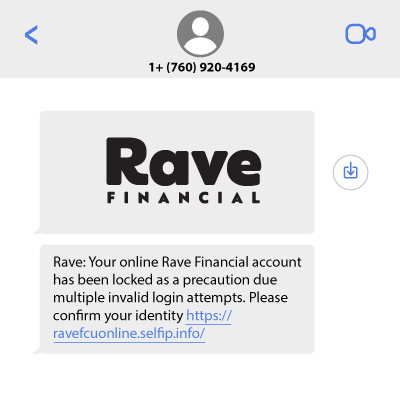

Please be aware of some of the text scams that are currently going around. Here are some examples of these text scams.

If you ever receive a similar text to any of these examples, please delete it immediately and do not click on any links.

If you accidentally did click the link, we recommend immediately logging in to your Rave Financial account and changing your online banking password. You'll also need to verify no changes have been made to your scheduled transfers, bill payments, and payees.

Example Fraud Texts

Fraud Defense

Some of the ways you can fight fraud:

1. Account Alerts: Monitoring your account frequently is one of the best ways to identify unauthorized activity.

2. Card Management Tool: If you ever need to block, freeze, or report a lost or stolen debit or credit card, you can use the card management tool.

Stay Secure

To protect yourself from fraud, these are some best practices that we recommend:

1. Use a unique password. Never use the same password for multiple accounts and channels. Keep your banking password unique so it's not easily guessed by hackers.

2. Change your password frequently. If you change your password regularly, this helps prevent fraudsters from accessing your account.

3. Never access your bank account or make purchases from public wifi. (For example: coffee shops, airports, stores, and hotels.)

4. Always shred paper that contains your private information. (For example: your full name, address, account numbers, pin numbers, and passwords.

5. Check your credit report once a year. You may request a credit report from a major trade bureau, such as: Equifax, TransUnion, or Experian.

6. Always report lost or stolen credit or debit cards. The sooner you can block your card, the better.

Fraud Help

If you notice fraudulent activity on a debit or credit card, follow these steps:

1. Log in to your account online or through our app and use the card management tool to block your card.

2. Next, report the fraudulent activity to us by either visiting a branch, using our Rave Video Banking App, or by calling our Fraud Department at 409-892-1111 (option 4).

Common Scams to be Aware of

Best Checking in Texas

Earn up to 6.10% APY

Announcements

- Updated Phone System Menu

- Mobile App Account Deletion

- Protecting Your Money

- 2026 Holiday Closings