Great Rates. Local Decisions. Local Service.

With competitive mortgage rates, low fees, and the best service in town, we're prepared to help you live your best life in a home that you love. If you're not sure what kind of loan is right for you, view our home loan solutions below as a guide to get you started. We're here to help you every step of the way.

The 5-Step Home Buying Guide

Buying a home is one of life’s biggest milestones—and at Rave Financial Credit Union, we’re here to help make it a little less overwhelming. That’s why we created our free, easy-to-follow 5 Step Home Buying Guide. Whether you’re buying your first home or your forever home, this guide walks you through the process to help you shop with confidence and offers insight you can trust.

Download your copy today and get access to helpful tips and expert advice—plus, when you opt in to our emails, you’ll receive more tools and updates to support you every step of the way. Because at Rave, we believe your home buying journey should feel as good as coming home.

Rate Protector Details:

At no cost, lock in your rate for 90 days while shopping for a home.

Re-lock the rate if rates decrease prior to closing.

No property required for applicant to lock a rate.

Available on home purchases and construction-to-perm loans.

Rate Swap Details:

Decrease your mortgage rate for free within the first 36 months!

One-time rate decrease if rates go down after closing.

Get the lowest qualifying rate at time of request.

No refinance fees.

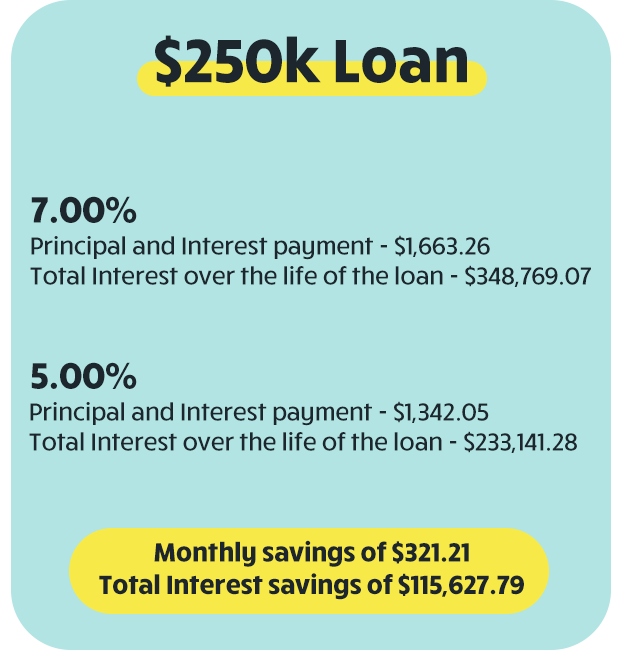

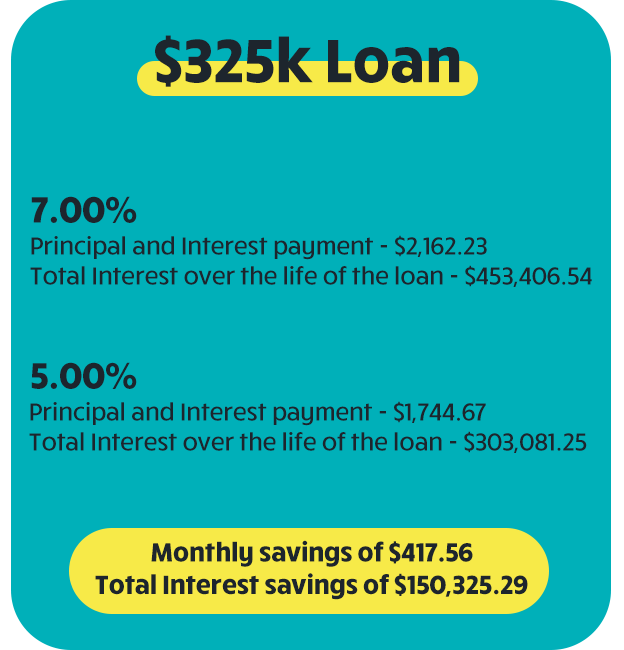

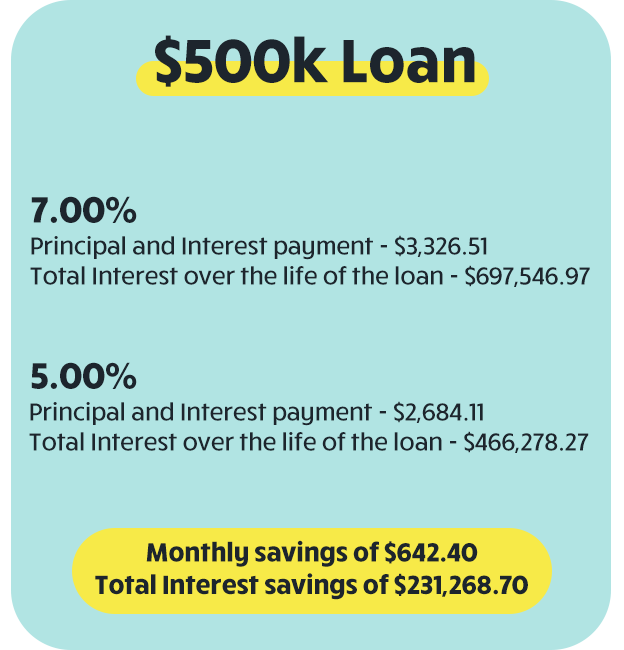

How much could you save with Rate Swap?

Here are a few loan examples below to demonstrate how much you could potentially save if published rates decrease by 2% and you execute your one-time Rate Swap.

Ready to get started?

Visit with one of our mortgage specialists to discuss the right home loan to meet your needs and budget. Simply give us a call, live video chat through our Rave Video Banking App, apply online, or fill out our contact form and we will reach out to you directly. Our local mortgage team is ready to fund your next home loan.

Contact Me

All loans serviced through Rave Financial. Rates are determined by credit rating and term. Applicants are qualified in accordance with Federal, State and NCUA laws as well as the provisions of the Fair Credit Reporting Act.

Best Checking in Texas

Earn up to 6.10% APY

Announcements

- Updated Phone System Menu

- Mobile App Account Deletion

- Protecting Your Money

- 2026 Holiday Closings